Your Score, In Your Hands. Stay Informed, Stay Ahead.

Checking your own score never reduces it — so take the first step today.

Your credit score shapes your financial future. With CIBIL Seva, you can check, track, and improve your CIBIL score instantly—without lowering it or harming your credit profile.

Why Choose CIBIL Seva

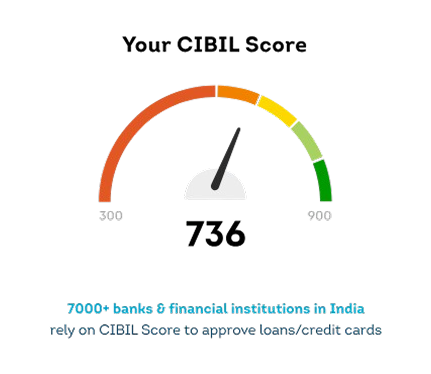

Credit Score

Understand where your financial health stands. Your CIBIL score is the first checkpoint lenders evaluate before approving loans and credit cards.

Payment History

Your repayment behavior affects nearly 35% of your credit score. Track your past payments and take control of your credit journey.

Improve Credit Score

Get insights and personalized suggestions to enhance your CIBIL score and unlock better financial opportunities.

Safe And Secure

Your data is encrypted and protected. We follow RBI-approved standards to keep your information safe at every step.

Your Trusted Platform to Check and Understand Your Credit Score

Your Trusted Platform to Check and Understand Your Credit Score

Your credit score plays a crucial role in your financial journey. Banks, NBFCs, and financial institutions review your score before approving any loan or credit card. With CIBIL Seva, you can quickly check your credit status, understand your credit behaviour, and take steps to improve it—securely and confidently.

Reach New Milestones With The Score Planner

Improving your credit score isn’t just a number game—it’s a journey toward greater financial freedom. With CIBIL Seva’s Score Planner, you gain powerful, data-driven insights that help you understand where you stand today and what steps you need to take to strengthen your credit profile. Our intelligent system reviews key elements of your credit behaviour—such as repayment history, credit utilization, past loan activity, and inquiries—and identifies the exact factors affecting your score. Based on this analysis, it provides personalized recommendations that are practical, achievable, and specifically tailored to your financial situation. Whether you're working toward a higher credit limit, better loan approval chances, or more attractive interest rates, the Score Planner empowers you to take control of your financial future.

Read MoreImproving your credit score isn’t just a number game—it’s a journey toward greater financial freedom. With CIBIL Seva’s Score Planner, you gain powerful, data-driven insights that help you understand where you stand today and what steps you need to take to strengthen your credit profile.

Our intelligent system reviews key elements of your credit behaviour—such as repayment history, credit utilization, past loan activity, and inquiries—and identifies the exact factors affecting your score. Based on this analysis, it provides personalized recommendations that are practical, achievable, and specifically tailored to your financial situation.

Whether you’re working toward a higher credit limit, better loan approval chances, or more attractive interest rates, the Score Planner empowers you to take control of your financial future.

Benefits of Checking Your Credit Score Regularly

Understand your current financial credibility, Improve your loan approval chances, Become eligible for better credit card and EMI offers, Correct errors in your credit report, if any, Build a strong financial profile before applying for loans. A good score opens doors—don’t wait for banks to reject your application. Stay prepared.

Our Achievements

15+

Years of Credit

Expertise

175+

Trusted Financial Partners Across India

Presence In 1,000+

Cities with a Wide Digital & Branch Network

Benefits Of Checking Your Credit Score

- Improve Loan Approval Chances

- Better Credit Card Offers

- Check EMI Eligibility

- Track Your Score Regularly

- Your credit score reflects your repayment behaviour and financial discipline, helping you plan better and avoid unnecessary loan rejections.

How It Works

Understanding your credit score is simple with CIBIL Seva. Our platform is designed to give you instant access to your credit information without any complications. Just follow a few easy steps, and you’ll have complete clarity about your financial standing and what you need to improve it.

1

Create Your Account

Sign up in seconds using your basic details.

2

Verify Your Information

Provide ID details for secure score generation.

3

Get Your Credit Score

Instantly access your CIBIL score and detailed credit report.

4

Plan & Improve

Follow our personalized suggestions to enhance your score and financial profile.

From Our Blog

Explore All

View All :-

Get in Touch With CIBIL Seva

Have questions about your credit score, report, or any feature on our platform? We’re here to help. Whether you want guidance on improving your credit score, understanding your credit history, or resolving any issue, our support team is ready to assist you.

Fill out the form below and one of our experts will get back to you shortly. Your financial clarity is just a message away.

Your credit journey doesn’t have to be confusing. At CIBIL Seva, we aim to provide transparent and easy-to-understand credit information so you can make informed financial decisions. If you’re facing any challenges, need clarity on your credit report, or simply want expert advice to improve your CIBIL score, we’re always ready to assist.

Submit your details through the form, and our team will reach out with the right guidance tailored to your needs.